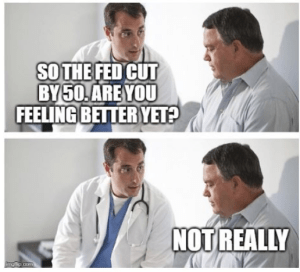

Now that the dust has settled on the Fed’s recent 50 basis point rate cut, it’s time to reflect on what the move means for small businesses, the economy, and the markets.

Does this rate cut kick off a recession? Do we have to wait for an official declaration, or should we continue to gather our own data from the real world?

Here are some opinions:

- This latest rate cut is the first reduction we’ve seen from the Fed since 2020. Some say this action is an implicit admission that they know the economy is weak and they’re behind the times.

- Strategist Danielle DiMartino Booth believes the U.S. is already in a recession and has been since April of this year. She also believes the Fed may have to cut rates even further because of economic weakness.

- Although normalized yield curves can signal a recession, that outcome isn’t always guaranteed. The years 1989, 1995, 1998, and 2019 all saw yield curves normalize and recessions were avoided.

Alright, the stage is set. Let’s get into how to brace ourselves for landing and the impact the cut has on banks, factors, and the small businesses we finance.

Prepare for Landing

We’ve been hearing the phrase “soft landing” so much that we might start to believe it’s already happened. However, economists tend to always call for a soft landing, regardless of what actually plays out.

Leading up to the crashes of 1990, 2001, and 2007, calls for a soft landing were everywhere.

The reality? Since 1980, the Fed has seen just one real soft landing. It came in the mid-1990s when there was no persistent yield curve inversion, a rare occurrence.

Compare that to this month where the yield curve turned positive after an impressive 565 consecutive inversion sessions. Most recessions start after the yield curve turns positive.

Another dose of reality: only 17% of rate cut cycles have resulted in a gentle outcome.

Some take a position on whether rate cuts are bullish or bearish. Others analyze the type of cut, emergency or normalizing, and use that to try to tell the story.

However, it might make more sense to consider the economy itself over anything else.

Bringing it Home

Regardless of what the charts say about inflation or who tells us things are cooling down, the little guys are still having a rough go.

Just 13% of small businesses reported plans to hire over the next three months. That’s the lowest it’s been since 2020. The last time we’ve seen plans decline like this was back in 2008 and it may point to a weakening labor market.

Just because small businesses are small doesn’t mean they don’t have a big impact. They employ over 46% of the private sector, which shakes out to around 61.7 million people.

The recent rate cut probably won’t impact hiring levels anytime in the near future. The bigger question might be whether or not we’ll see borrowing resume. Can American families take on more debt?

Households with over $100K incomes might not be struggling as much as many other Americans, but they too are making personal budget cuts. Roughly 25% of them reported scaling back on dinners out.

This crew contributes around 60 cents out of every dollar spent at restaurants.

Mortgage rates are -1.6% from their peak. Refinances did increase, but not by much at all. Even before the rate hikes, homebuying was at a 15 year low. To level things out, costs need to be relative to incomes.

If we look at the 10 year rates, we find that they actually increased. This is what mortgage lending is based on. The Fed essentially cut rates nobody borrows at.

Forward and Onward

The Fed’s recent rate cut was on the radar for months and we’ve been expecting it for over a year. However, it certainly doesn’t end the drama we’re experiencing. It’s simply the next act in our ever-evolving story.

Just as the market ebbs and flows, life moves back and forth between old and new. As heroes on the journey, we either evolve with the changes or stay stagnant as the world keeps turning.

When a hero successfully makes it through an entire cycle, the journey isn’t over. A new leg of the trip is waiting around the corner and this time, you’re equipped with the tools and treasures you’ve gained thus far.

At the end of the day, it’s all about integration. History may repeat itself, but we can help steer our own ships through mastery and lessons learned.

At Dare, we have a calling to support entrepreneurs on this journey. Through both the old and new, we’re in it to win it.

We aim to help you master both worlds with as much clarity as possible and the support you need to forge ahead.

Through our Back Room Service, you’ll get access to:

- Greater Income (like a lot more)

- Owning assets instead of commissions

- Zero investment down

- No personal liability

- Fifty-fifty split on risks and profits

- Portfolio management software from NN6, LLC

Looking for a trusted partner? Give us a call.

If you enjoyed this newsletter, pass it along to your friends.

No comment yet, add your voice below!