We’ve had another couple of interesting weeks to reflect on and the excitement keeps on coming. Although we can’t say any of the recent excitement comes as a surprise.

We’re fresh off J. Powell’s Jackson Hole remarks about impending rate cuts our crystal ball revealed to us some time ago. What could it mean for both Wall Street and Main Street?

Another crystal ball premonition turned reality: job numbers were a huge fugazi.

A giant revision just took place and still, the media tells us there are no signs of a recession. How much longer can the great Wizard of Oz play this game? Remember, we are in a contentious election year.

Let’s take a closer look at these recent happenings and why your biggest enemy may be closer than you think.

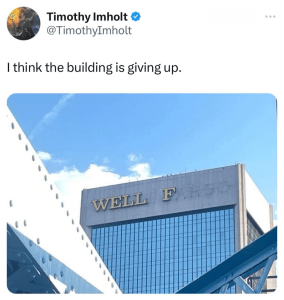

A Job Well Done

The big question on so many minds: should we keep believing data that ultimately proves to be wrong?

The BLS recently released a whopper of a revision to their jobs numbers. With groundbreaking AI and tech at our fingertips, how do such gross miscalculations happen in our age? Maybe the robots should take some jobs.

The revisions showed the economy added 818,000 fewer jobs than originally reported over the 12 months ending in March. Job growth was actually up 1.4% instead of the 1.9% they originally led with.

This revision is the largest we’ve seen since 2009. Just like that, 25% of total job gains vanished into thin air. Looking at our history books, we can begin to mentally prepare for what’s likely ahead.

The last two recessions really started taking off in June. If the past is any indication of our future, August data could show a pretty rapid (and undeniable) economic decline in July.

It’s not totally tinfoil hat to think it’s all got something to do with it being an election year. Of course, padding the numbers and convincing America the economy is doing better than it really is makes it all go down smoother.

Where Credit is Due

A big piece in the recession puzzle still looming in the crystal ball is of course, lending.

Right now, bank lending is at its lowest rate of any expansion in our history. We’ve only seen lower credit growth during recessions. So, are we in one?

We also can’t forget about commercial property. Foreclosures hit $20.6B in Q2, the highest we’ve seen since Q3 of 2015.

Another troubling data point: since 2020, commercial property foreclosures more than doubled, climbing at their quickest pace since the 2008 crisis.

Additionally, lender portfolios of foreclosed commercial properties jumped 13% last quarter. With a pocket full of wishful thinking, many lenders hoped CRE would sort itself out. But that’s not happening.

Gentle reminder that there’s over $6 trillion in CRE debt in the US, half of which is held by banks.

To dice it up even further, 70% of that debt is held by small banks. The kind that almost collapsed in the regional bank crisis.

The Enemy Within

As investors, lenders, and Factors (and as humans), we’re wired to push away ideas or beliefs that don’t align with our own personal brand. It’s our cognitive bias. So many people put themselves at the mercy of how the markets behave, which can be a costly mistake.

We preach a lot about mastering fundamentals so you can weather storms. In these times, it’s more important than ever.

When your hypothetical ship is steady, your crew has it all under control, and you’re fixed on your ultimate destination, you’re not thrown off course by some unexpected turbulence.

On the hero’s journey, there are enemies and allies. When we scan our surroundings for those who might take us off our path, we can’t forget to look in the mirror.

Ask yourself who you really are when you’re faced with danger and uncertainty. Are you the rock that holds it all together, or do you get sucked into the unpredictable chaos?

Are you an enemy to your purpose or are you an ally? Find your calm in the storm so you can cross that threshold.

At Dare, we know the journey is always better when you have more allies on your side.

Through our Back Room Service, you’ll get access to:

- Greater Income (like a lot more)

- Owning assets instead of commissions

- Zero investment down

- No personal liability

- Fifty-fifty split on risks and profits

- Portfolio management software from NN6, LLC

Curious about how we can help? Give us a call.

If you enjoyed this newsletter, pass it along to your friends.

No comment yet, add your voice below!